It’s a known fact that car insurance companies don’t want you to look for cheaper rates. Insureds who get price comparisons will presumably move their business because there is a good probability of finding coverage at a more affordable price. A recent survey discovered that drivers who compared rates once a year saved an average of $72 a month compared to those who don’t make a habit of comparing rates.

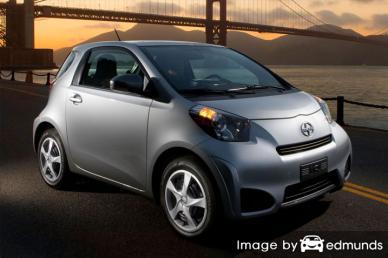

If finding the lowest rates on Scion iQ insurance in Omaha is your objective, then having some insight into the best ways to find and compare car insurance can save time, money, and frustration.

The best way we recommend to get cheaper Scion iQ insurance in Omaha is to compare quotes once a year from companies who can sell car insurance in Nebraska.

The best way we recommend to get cheaper Scion iQ insurance in Omaha is to compare quotes once a year from companies who can sell car insurance in Nebraska.

- Gain an understanding of how car insurance works and the modifications you can make to lower rates. Many risk factors that cause high rates such as accidents, traffic tickets, and a lousy credit rating can be controlled by improving your driving habits or financial responsibility.

- Request rate estimates from independent agents, exclusive agents, and direct companies. Exclusive and direct companies can only give prices from one company like GEICO and State Farm, while agents who are independent can quote prices from many different companies. View prices

- Compare the new rate quotes to your existing policy and determine if cheaper iQ coverage is available in Omaha. If you find better rates, make sure there is no lapse in coverage.

- Tell your current company to cancel your current car insurance policy. Submit any necessary down payment along with the completed application for your new coverage. Make sure you store the certificate of insurance with your vehicle’s registration.

An essential thing to point out is to compare identical deductibles and limits on each quote and and to compare all possible companies. This enables a fair price comparison and the most accurate and complete price analysis.

How much does Scion iQ insurance in Omaha, Nebraska cost?

It’s important to know that comparing more quotes helps you find more affordable insurance. Not every company does online Omaha iQ insurance quotes, so you also need to get prices on coverage from those companies, too.

The companies in the list below are our best choices to provide comparison quotes in Omaha, NE. If you want to find the cheapest auto insurance in Omaha, it’s a good idea that you visit as many as you can to find the cheapest car insurance rates.

Cheaper rates with these price cutting discounts

Not many people think insurance is cheap, but you may qualify for discounts that many people don’t even know exist. A few discounts will automatically apply at the time of purchase, but some discounts are required to be specifically requested before they will apply.

- ABS Brakes – Cars and trucks that have anti-lock braking systems are much safer to drive and qualify for as much as a 10% discount.

- Auto/Life Discount – Not all companies offer life insurance, but some may give you a break if you buy life insurance from them.

- Home Ownership Discount – Just being a homeowner may earn you a small savings due to the fact that maintaining a home requires personal responsibility.

- Safe Drivers – Drivers without accidents can get discounts for up to 45% lower rates than their less cautious counterparts.

- Discount for Passive Restraints – Vehicles with factory air bags can get savings up to 30%.

- Savings for New Vehicles – Buying a new car instead of a used iQ is cheaper since new model year vehicles have better safety ratings.

- College Student – Older children who attend college more than 100 miles from Omaha and do not have a car could get you a discount.

- Senior Citizens – Mature drivers could receive a small decrease in premiums.

- Driver’s Ed – Teen drivers should successfully take a driver’s education course as it can save substantially.

You can save money using discounts, but some of the credits will not apply to the entire cost. Some only reduce individual premiums such as liability, collision or medical payments. If you do the math and it seems like it’s possible to get free car insurance, it’s just not the way it works.

Some of the insurance companies that may include some of the above discounts include:

When quoting, ask each company or agent the best way to save money. Depending on the company, some discounts might not be offered on policies in Omaha. To view providers with discount rates in Nebraska, click this link.

Car insurance is available from local agents

Many people still prefer to talk to an insurance agent and often times that is recommended An additional benefit of price shopping on the web is you may find lower rates and also buy local.

After completing this short form, your coverage information is instantly submitted to agents in your area who will give you quotes for your business. It simplifies rate comparisons since you won’t have to even leave your home as quotes are delivered directly to your email. You can most likely find cheaper rates and an insurance agent to talk to. If you want to compare rates from a specific insurance company, don’t hesitate to navigate to their website to submit a rate quote request.

After completing this short form, your coverage information is instantly submitted to agents in your area who will give you quotes for your business. It simplifies rate comparisons since you won’t have to even leave your home as quotes are delivered directly to your email. You can most likely find cheaper rates and an insurance agent to talk to. If you want to compare rates from a specific insurance company, don’t hesitate to navigate to their website to submit a rate quote request.

Finding a good insurance company should include more criteria than just the price. Some important questions to ask are:

- Which companies can they place coverage with?

- Are aftermarket or OEM parts used to repair vehicles?

- How often do they review policy coverages?

- Which company do they place the most coverage with?

- Will you work with the agent or an assistant?

- If you raise deductibles, how much can you save?

- Are they able to influence company decisions when a claim is filed?

Listed below are agents in Omaha that can give you price quote information for Scion iQ insurance in Omaha.

- Southwell Insurance Agency, LLC.

2809 S 160th St #307 – Omaha, NE 68130 – (402) 493-6940 – View Map - Auto Insurance Mart

1913 Military Ave – Omaha, NE 68111 – (402) 553-0700 – View Map - Cyrus Jaffery – State Farm Insurance Agent

3015 North 90th Street Ste 3 – Omaha, NE 68134 – (402) 451-2500 – View Map - American Family Insurance – S De Los Reyes Agency Inc.

5052 S 108th St – Omaha, NE 68137 – (402) 339-9052 – View Map

Components of Your Scion iQ Insurance Costs

An important part of buying insurance is that you know the different types of things that aid in calculating auto insurance rates. If you have a feel for what determines base rates, this enables informed choices that could help you find big savings.

- Driving citations increase premiums – Having just one chargeable violation can increase rates to the point where it’s not affordable. Careful drivers get better rates than bad drivers. Drivers unfortunate enough to have serious violations like DWI, reckless driving or hit and run convictions may face state-mandated requirements to submit a SR-22 or proof of financial responsibility to the state department of motor vehicles in order to legally drive a vehicle.

- Prices impacted by vehicle usage – Driving a lot of miles in a year’s time the higher your rate. A lot of insurance companies calculate prices partially by how you use the vehicle. Cars and trucks that have low annual miles can be on a lower rate level as compared to vehicles used primarily for driving to work. Having the wrong rating on your iQ may be costing you higher rates. Double check that your vehicle rating properly reflects the correct driver usage, because it can save money.

- Do you know your coverage deductibles? – Your deductibles are the amount of money you are willing to pay out-of-pocket before your auto insurance pays a claim. Physical damage protection, also called ‘full coverage’, is used to repair damage to your car. Examples of covered claims could be a windshield broken by a bird, collision with a deer, and damage caused by road hazards. The more damage repair cost the insured is willing to pay, the lower your rates will be.

- Responsible credit scores equal low prices – Having a bad credit rating is a large factor in determining what you pay. Therefore, if your credit score can use some improvement, you could save money insuring your Scion iQ by repairing your credit. Drivers with high credit ratings tend to be more responsible than those with bad credit.

-

Scion iQ historical loss data – Companies include the past claim trends for vehicles to help determine prices. Models that statistically have a higher amount or frequency of claims will have increased rates. The data below shows the compiled insurance loss statistics for Scion iQ vehicles.

For each coverage type, the statistical loss for all vehicles, as an average, is a value of 100. Values under 100 are indicative of better than average losses, while numbers above 100 indicate more frequent losses or an increased chance of larger losses than average.

Auto Insurance Loss Data for Scion iQ Models Vehicle Make and Model Collision Property Damage Comp Personal Injury Medical Payment Bodily Injury Scion iQ 77 81 75 BETTERAVERAGEWORSEEmpty fields indicate not enough data collected

Data Source: iihs.org (Insurance Institute for Highway Safety) for 2013-2015 Model Years

Auto insurance in Nebraska serves several purposes

Despite the potentially high cost of Scion iQ insurance, auto insurance serves a purpose in several ways.

- The majority of states have minimum mandated liability insurance limits which means it is punishable by state law to not carry specific minimum amounts of liability protection in order to drive the car. In Nebraska these limits are 25/50/25 which means you must have $25,000 of bodily injury coverage per person, $50,000 of bodily injury coverage per accident, and $25,000 of property damage coverage.

- If you bought your vehicle with a loan, more than likely the lender will have a requirement that you have physical damage coverage to protect their interest in the vehicle. If you let the policy lapse, the lender will be forced to insure your Scion at an extremely high rate and force you to pay the higher premium.

- Auto insurance preserves not only your Scion but also your financial assets. It also can pay for medical transport and hospital expenses for not only you but also any passengers injured in an accident. Liability insurance, one of your policy coverages, will also pay attorney fees if you are named as a defendant in an auto accident. If mother nature or an accident damages your car, collision and comprehensive coverages will pay to restore your vehicle to like-new condition.

The benefits of buying enough insurance outweigh the cost, especially if you ever need it. According to a 2015 survey, the average American driver is currently overpaying as much as $850 per year so shop around at every renewal to ensure rates are competitive.

Cheaper car insurance is a realistic goal

Insureds change insurance companies for a variety of reasons including delays in responding to claim requests, unfair underwriting practices, delays in paying claims and poor customer service. Regardless of your reason, finding a new car insurance company can be less work than you think.

When you buy Omaha auto insurance online, it’s not a good idea to sacrifice coverage to reduce premiums. Too many times, drivers have reduced physical damage coverage only to discover later that they should have had better coverage. The proper strategy is to find the BEST coverage at the best cost and still be able to protect your assets.

We just covered many tips how you can lower your Scion iQ insurance prices in Omaha. The key concept to understand is the more rate quotes you have, the more likely it is that you will get a better rate. Consumers could even find that the most savings is with some of the smallest insurance companies.

To read more, feel free to visit the resources below:

- Medical Payments Coverage (Liberty Mutual)

- Who Has Cheap Omaha Auto Insurance for Unemployed Drivers? (FAQ)

- Who Has Affordable Auto Insurance for Low Credit Scores in Omaha? (FAQ)

- How Much are Car Insurance Rates for Real Estate Agents in Omaha? (FAQ)

- Auto Crash Statistics (Insurance Information Institute)

- Liability Insurance Coverage (Nationwide)