Unthinkable but true, almost 70% of insureds kept their policy with the same company for at least the last four years, and almost half have never quoted auto insurance rates at all. Nebraska consumers could save as much as $388 every year, but they just assume it’s a time-consuming process to compare rates and save money.

The most effective way to save money on car insurance rates in Omaha is to start doing an annual price comparison from different companies in Nebraska. Drivers can shop around by following these steps.

The most effective way to save money on car insurance rates in Omaha is to start doing an annual price comparison from different companies in Nebraska. Drivers can shop around by following these steps.

- Take a little time to learn about car insurance and the measures you can control to prevent rate increases. Many risk factors that drive up the price like your driving record and a substandard credit score can be amended by making small lifestyle or driving habit changes. This article provides more information to help prevent expensive coverage and find discounts that you may qualify for.

- Obtain price quotes from direct carriers, independent agents, and exclusive agents. Direct companies and exclusive agencies can only quote rates from a single company like GEICO or State Farm, while independent agencies can provide price quotes from multiple sources.

- Compare the new rates to the price on your current policy to see if a cheaper price is available in Omaha. If you find a lower rate quote and buy the policy, make sure the effective date of the new policy is the same as the expiration date of the old one.

- Tell your current company of your intent to cancel your current car insurance policy. Submit a completed application and payment to your new agent or company. Once received, safely store the certificate verifying proof of insurance along with your vehicle registration.

A good tip to remember is that you’ll want to compare identical coverage information on each price quote and and to get price quotes from every insurance company. Doing this enables the most accurate price comparison and a good representation of prices.

If you have coverage now or are looking for a new policy, you can use these tips to get lower rates and possibly find even better coverage. Shopping for the most affordable insurance coverage in Omaha is easy to do. Vehicle owners just need to learn the most efficient way to quote multiple rates on the web.

Get Cheap Insurance Costs by Understanding These Factors

Part of the auto insurance buying process is learning the factors that play a part in calculating your auto insurance rates. If you have a feel for what impacts premium levels, this enables you to make decisions that may reward you with lower premium levels.

Shown below are some of the most common factors utilized by car insurance companies to help set rates.

Frequent claims increase prices – If you’re an insured who likes to file claims you can expect higher rates. Car insurance companies in Nebraska give most affordable rates to policyholders who only file infrequent claims. Your insurance policy is meant to be used in the event of claims that pose a financial burden.

Prevent your car from being stolen – Owning a car with anti-theft technology or alarm system can earn a premium discount. Systems that thwart thieves like GM’s OnStar, tamper alarm systems and vehicle immobilizers can help prevent car theft and help bring rates down.

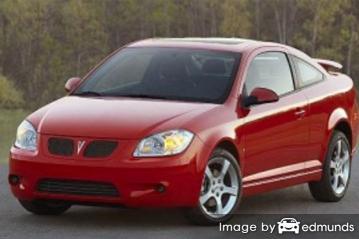

Know your credit rating – A driver’s credit history is a big factor in determining what you pay for auto insurance. Consumers who have excellent credit scores tend to be better risks to insure than those with worse credit. If your credit could use some work, you could be paying less to insure your Pontiac G5 by improving your rating.

How many miles do you drive? – Driving more miles in a year the higher the price you pay to insure it. The majority of insurers rate vehicles based upon how you use the vehicle. Cars and trucks that do not get driven very much qualify for better rates than those used for commuting. Verify your vehicle rating is showing how each vehicle is driven. A policy that improperly rates your G5 is just wasting money.

Getting a cheaper price on Pontiac G5 insurance can be surprisingly simple. Drivers just need to take time comparing price quotes to discover which company has inexpensive Omaha auto insurance quotes.

The companies in the list below provide quotes in Omaha, NE. To buy the best auto insurance in Omaha, we suggest you visit two to three different companies in order to find the cheapest rates.

Choosing Pontiac G5 insurance is an important decision

Despite the potentially high cost of Pontiac G5 insurance, insurance may be required for several reasons.

- Almost all states have minimum liability requirements which means it is punishable by state law to not carry specific limits of liability coverage in order to get the vehicle licensed. In Nebraska these limits are 25/50/25 which means you must have $25,000 of bodily injury coverage per person, $50,000 of bodily injury coverage per accident, and $25,000 of property damage coverage.

- If you bought your G5 with a loan, it’s guaranteed your bank will require you to have physical damage coverage to guarantee their interest in the vehicle. If you do not pay your insurance premiums, the bank may insure your Pontiac at a significantly higher premium and force you to pay the higher premium.

- Insurance preserves both your Pontiac and your assets. It will also provide coverage for hospital and medical expenses for you, any passengers, and anyone injured in an accident. Liability coverage also pays for attorney fees and expenses if you are sued as the result of your driving. If you have damage to your Pontiac as the result of the weather or an accident, comprehensive and/or collision insurance will cover the repair costs.

The benefits of carrying enough insurance outweigh the cost, specifically if you ever have a liability claim. Despite what companies tell you, the average driver is overpaying over $810 a year so it’s very important to do a rate comparison every year to save money.

Get cheaper Pontiac G5 insurance in Omaha with discounts

Car insurance is not cheap, but there are discounts available to help bring down the price. Most are applied at the time of quoting, but some must be asked about before being credited.

- Driver Safety – Taking a driver safety course can save you 5% or more and make you a better driver.

- Early Payment Discounts – If you pay your bill all at once instead of monthly or quarterly installments you could save 5% or more.

- Discount for Life Insurance – If the company offers life insurance, you could get a small discount if you purchase some life insurance in addition to your auto policy.

- Low Mileage – Fewer annual miles on your Pontiac can qualify you for cheaper premium rates.

- Senior Citizens – If you qualify as a senior citizen, you are able to get better car insurance rates.

- Discount for New Cars – Buying insurance on a new vehicle can cost up to 25% less compared to insuring an older model.

Please keep in mind that most credits do not apply to the overall cost of the policy. Some only apply to the cost of specific coverages such as liability and collision coverage. So even though you would think all those discounts means the company will pay you, companies wouldn’t make money that way.

A few popular companies and their possible discounts are shown below.

- State Farm discounts include passive restraint, driver’s education, defensive driving training, accident-free, and safe vehicle.

- American Family offers discounts including Steer into Savings, accident-free, good student, early bird, TimeAway discount, bundled insurance, and mySafetyValet.

- GEICO may offer discounts for daytime running lights, anti-lock brakes, federal employee, defensive driver, and multi-vehicle.

- 21st Century has savings for student driver, homeowners, anti-lock brakes, theft prevention, early bird, air bags, and 55 and older.

- Progressive has discounts for multi-policy, online signing, homeowner, multi-vehicle, and good student.

Before buying, ask each insurance company what discounts are available to you. Some discounts may not be available in Omaha. If you would like to view car insurance companies that can offer you the previously mentioned discounts in Omaha, click here.

What if I want to buy from local Omaha car insurance agents?

A small number of people still like to sit down and talk to an agent and doing so can bring peace of mind Professional insurance agents will help you protect your assets and help in the event of a claim. The biggest benefit of comparing car insurance online is you may find the lowest rates and still choose a local agent.

Once you complete this short form, your coverage information is sent to insurance agents in Omaha who will gladly provide quotes for your insurance coverage. You won’t need to leave your computer since rate quotes are delivered immediately to you. If you wish to quote rates from one company in particular, don’t hesitate to go to their quote page and complete a quote there.

Once you complete this short form, your coverage information is sent to insurance agents in Omaha who will gladly provide quotes for your insurance coverage. You won’t need to leave your computer since rate quotes are delivered immediately to you. If you wish to quote rates from one company in particular, don’t hesitate to go to their quote page and complete a quote there.

Deciding on a insurer should include more criteria than just a cheap price quote. These are some valid questions you should ask.

- Will they take your side in the event of a claim?

- Who is covered by the car insurance policy?

- Can you get a list of referrals?

- Is vehicle mileage a factor when determining depreciation for repairs?

- How often do they review coverages?

- Which companies do they recommend if they are an independent agency?

Shown below are agents in Omaha that can give you rate quotes for Pontiac G5 insurance in Omaha.

- Vander Vorst Insurance Agency

15037 Industrial Rd – Omaha, NE 68144 – (402) 330-7979 – View Map - Southwell Insurance Agency, LLC.

2809 S 160th St #307 – Omaha, NE 68130 – (402) 493-6940 – View Map - Farmers Insurance – Lance Juett

2708 S 114th St – Omaha, NE 68144 – (402) 315-1554 – View Map - State Farm® insurance – Beau Iske

13829 Millard Ave – Omaha, NE 68137 – (402) 895-4424 – View Map

After receiving acceptable answers for all questions you ask and a good coverage price, you may have found a company that meets your needs to insure your vehicles. Just understand that you can always terminate your policy when you choose so never assume that you are permanently stuck with any particular company for a certain time period.

How do I know if I need professional advice?

When it comes to choosing the right insurance coverage, there really is no “best” method to buy coverage. Your needs are unique to you so this has to be addressed.

For instance, these questions can help discover if your situation would benefit from professional advice.

- Can my babysitter drive my car?

- If my pet gets injured in an accident are they covered?

- What does roadside assistance cover?

- Does my medical payments coverage pay my health insurance deductible?

- Does every company file a SR-22 automatically?

- Do I have coverage if I rent a car in Mexico?

If you’re not sure about those questions, you might consider talking to an agent. To find an agent in your area, fill out this quick form or click here for a list of car insurance companies in your area. It’s fast, free and can provide invaluable advice.

Cheaper auto insurance prices are available

Some auto insurance companies do not offer internet price quotes and usually these smaller companies sell through independent agents. The cheapest Pontiac G5 insurance in Omaha can be found from both online companies and from local insurance agents, so you should compare both so you have a total pricing picture.

When shopping online for auto insurance, don’t be tempted to sacrifice coverage to reduce premiums. In too many instances, an insured cut liability coverage limits and learned later that they should have had better coverage. Your objective should be to find the BEST coverage at a price you can afford and still be able to protect your assets.

More detailed auto insurance information is located at these sites:

- What is Gap Insurance? (Insurance Information Institute)

- Who Has the Cheapest Car Insurance Rates for a Learners Permit in Omaha? (FAQ)

- Who Has Affordable Auto Insurance for Young Drivers in Omaha? (FAQ)

- What is the Best Cheap Auto Insurance in Omaha, Nebraska? (FAQ)

- Who Has the Cheapest Car Insurance for a 20 Year Old Female in Omaha? (FAQ)

- Car Insurance for Teen Drivers with Divorced Parents (Allstate)

- Vehicle Safety Ratings (iihs.org)

- Learn About Car Insurance (GEICO)

- Where can I buy Insurance? (Insurance Information Institute)