Unimaginable but true, most consumers in Nebraska kept buying from the same company for a minimum of four years, and practically 40% of insurance customers have never compared rates to find cheap insurance. The average driver in the United States could save an average of as much as 46.5% each year, but they just don’t understand the benefits if they switched to a more affordable policy.

The best way to find cheaper quotes for Acura ZDX insurance in Omaha is to begin comparing prices regularly from insurers who provide car insurance in Nebraska. Price quotes can be compared by following these guidelines.

The best way to find cheaper quotes for Acura ZDX insurance in Omaha is to begin comparing prices regularly from insurers who provide car insurance in Nebraska. Price quotes can be compared by following these guidelines.

- First, try to learn a little about what coverages are included in your policy and the steps you can take to keep rates low. Many things that drive up the price such as traffic tickets, fender benders, and a less-than-favorable credit rating can be remedied by making small lifestyle or driving habit changes.

- Second, obtain price quotes from exclusive agents, independent agents, and direct providers. Direct and exclusive agents can only provide price estimates from a single company like Progressive and State Farm, while independent agents can provide prices for a wide range of insurance providers.

- Third, compare the new quotes to your existing policy to see if cheaper ZDX coverage is available. If you can save money, make sure coverage does not lapse between policies.

- Fourth, provide notification to your current agent or company of your intention to cancel the current policy and submit payment and a completed application for the new coverage. As soon as you receive it, place the new proof of insurance paperwork along with your vehicle registration.

A key point to remember is to make sure you enter identical limits and deductibles on every quote and to quote with as many carriers as you can. Doing this provides the most accurate price comparison and and a good selection of different prices.

The purpose of this article is to introduce you to the best way to quote coverages and some tricks to saving. If you are insured now, you will definitely be able to reduce premiums using the ideas you’re about to read. Comparison shoppers just need to understand the most efficient way to compare different rates online.

How much is Acura ZDX insurance in Omaha, NE?

Finding cheaper insurance quotes doesn’t have to be difficult. You just need to spend a few minutes on the computer to get quotes to find the company with affordable Omaha car insurance quotes.

Getting rates online is very simple and it makes it obsolete to make phone calls or go to insurance agents’ offices. Comparing online rate quotes makes this unnecessary unless you require the personal advice of a local Omaha agent. Although you can find lower rates online and get advice from an agent in your area.

The companies shown below can provide comparison quotes in Omaha, NE. In order to find the best cheap car insurance in Nebraska, we suggest you visit several of them to find the lowest car insurance rates.

Coverage statistics and figures

The table displayed below highlights detailed analysis of coverage costs for Acura ZDX models. Being aware of how insurance premiums are calculated can be of help when making decisions on the best policy coverages.

| Model | Comp | Collision | Liability | Medical | UM/UIM | Annual Premium | Monthly Premium |

|---|---|---|---|---|---|---|---|

| ZDX Technology Package AWD | $276 | $518 | $314 | $18 | $94 | $1,220 | $102 |

| ZDX AWD | $276 | $518 | $314 | $18 | $94 | $1,220 | $102 |

| ZDX Advance Package AWD | $276 | $588 | $314 | $18 | $94 | $1,290 | $108 |

| Get Your Own Custom Quote Go | |||||||

Table data represents married female driver age 40, no speeding tickets, no at-fault accidents, $250 deductibles, and Nebraska minimum liability limits. Discounts applied include claim-free, multi-policy, safe-driver, multi-vehicle, and homeowner. Price estimates do not factor in zip code location which can change rates substantially.

Higher deductibles lower rates

One frequently asked question is where to set your physical damage deductibles. The tables below can help you visualize the premium difference when you select higher and lower policy deductibles. The first rate estimation uses a $250 deductible for physical damage and the second rate table uses a $500 deductible.

| Model | Comp | Collision | Liability | Medical | UM/UIM | Annual Premium | Monthly Premium |

|---|---|---|---|---|---|---|---|

| ZDX Technology Package AWD | $322 | $530 | $300 | $18 | $90 | $1,285 | $107 |

| ZDX AWD | $322 | $530 | $300 | $18 | $90 | $1,285 | $107 |

| ZDX Advance Package AWD | $322 | $600 | $300 | $18 | $90 | $1,355 | $113 |

| Get Your Own Custom Quote Go | |||||||

| Model | Comp | Collision | Liability | Medical | UM/UIM | Annual Premium | Monthly Premium |

|---|---|---|---|---|---|---|---|

| ZDX Technology Package AWD | $262 | $428 | $300 | $18 | $90 | $1,098 | $92 |

| ZDX AWD | $262 | $428 | $300 | $18 | $90 | $1,098 | $92 |

| ZDX Advance Package AWD | $262 | $484 | $300 | $18 | $90 | $1,154 | $96 |

| Get Your Own Custom Quote Go | |||||||

Data based on married male driver age 30, no speeding tickets, no at-fault accidents, and Nebraska minimum liability limits. Discounts applied include homeowner, safe-driver, multi-vehicle, multi-policy, and claim-free. Rates do not factor in Omaha location which can influence coverage prices significantly.

Based on this data, we can arrive at the conclusion that using a $250 deductible will cost you approximately $16 more each month or $192 each year averaged for all ZDX models than selecting the higher $500 deductible. Since you would have to pay $250 more out-of-pocket with a $500 deductible as compared to a $250 deductible, if you tend to average more than 16 months between claim filings, you would most likely save money if you decide on a higher deductible. The numbers below show a better example of how we made this calculation.

| Average monthly premium for $250 deductibles: | $109 |

| Average monthly premium for $500 deductibles (subtract): | – $93 |

| Monthly savings from raising deductible: | $16 |

| Difference between deductibles ($500 – $250): | $250 |

| Divide difference by monthly savings: | $250 / $16 |

| Number of months required between physical damage coverage claims in order to save money by choosing the higher deductible | 16 months |

Drive safe and save

The chart below highlights how speeding tickets and at-fault collisions impact Acura ZDX auto insurance rates for each age group. The rate quotes are based on a married female driver, comprehensive and collision coverage, $1,000 deductibles, and no policy discounts are applied.

Insurance premiums for males and females

The chart below shows the comparison of Acura ZDX insurance prices for male and female drivers. The rate quotes are based on a clean driving record, no claims, full coverage, $100 deductibles, drivers are not married, and no policy discounts are applied.

Acura ZDX liability rates compared to full coverage

The information below shows the comparison of Acura ZDX premium costs with full coverage compared to only the Nebraska minimum liability coverage. The premiums assume no violations or accidents, $500 deductibles, single status, and no discounts are factored in.

When to switch to liability coverage only

There is no exact formula for eliminating full coverage, but there is a general guideline you can use. If the annual cost of comprehensive and collision coverage is more than about 10% of the vehicle’s replacement cost less your deductible, then it might be time to buy liability only.

For example, let’s assume your Acura ZDX book value is $7,000 and you have $1,000 policy deductibles. If your vehicle is damaged in an accident, the most your company will settle for is $6,000 after you pay the deductible. If you are paying more than $600 a year to have full coverage, then it’s probably a good time to buy liability coverage only.

There are some circumstances where buying only liability insurance is not financially feasible. If you still owe a portion of the original loan, you must maintain physical damage coverage to satisfy the loan requirements. Also, if you cannot afford to purchase a different vehicle in the event your current vehicle is totaled, you should keep full coverage on your policy.

What Determines Acura ZDX Insurance Premiums?

Multiple criteria are taken into consideration when you get your auto insurance bill. Some are obvious such as traffic violations, but other factors are less apparent such as your marital status or your vehicle rating. A large part of saving on auto insurance is knowing some of the things that aid in calculating your premiums. When you know what positively or negatively determines premiums, this allows you to make good choices that could result in lower premium levels.

The itemized list below are a few of the things used by companies to determine your premiums.

- Marriage pays dividends – Having a wife or husband may cut your premiums compared to being single. Having a spouse generally demonstrates drivers are more stable financially and insurance companies reward insureds because married drivers get in fewer accidents.

- Your employer and auto insurance rates – Jobs such as military generals, police officers, and medical professionals generally have higher rates than average due to job stress and lengthy work days. Conversely, jobs like actors, engineers and performers get better rates.

- Rates can drop if you have more than one policy – Most major insurance companies give a discount to policyholders that buy multiple policies such as combining an auto and homeowners policy. Discounts can amount to anywhere from five to ten percent in most cases. Even with this discount applied, it’s always a smart idea to check prices from other companies to help guarantee you have the best rates.

- Increase comp and collision deductibles and save – Coverage for physical damage, also known as collision and other-than-collision, protects your Acura from damage. Examples of covered claims are colliding with a building, hitting a deer, and rolling your vehicle. Physical damage deductibles represent how much money you are required to spend out-of-pocket if a claim is determined to be covered. The more money you choose to pay out-of-pocket, the lower your rates will be.

-

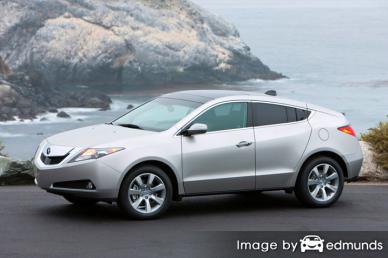

Premiums go up with performance – The make and model of the car, truck or SUV you need insurance for makes a significant difference in the rate you pay. Smaller low performance passenger vehicles generally have the cheapest insurance rates, but other factors influence the final cost greatly.

The data below uses these variables: married female driver age 20, full coverage with $250 deductibles, and no discounts or violations. It shows Acura ZDX rates compared to other models that have a range of risk factors.

- City traffic equals higher prices – Living in areas with lower population is a positive aspect when trying to find low car insurance rates. City drivers have to deal with traffic congestion and longer commutes to work. Less people living in that area means fewer accidents and a lower car theft rate.

- How credit rating affects auto insurance costs – Your credit rating is a large factor in your rate calculation. People that have excellent credit tend to be more responsible than drivers who have poor credit scores. If your credit score is lower than you’d like, you could potentially save money when insuring your Acura ZDX by spending a little time repairing your credit.

Why do I need car insurance?

Even though Omaha ZDX insurance rates can get expensive, paying for auto insurance is required for several reasons.

- Most states have minimum mandated liability insurance limits which means it is punishable by state law to not carry a specific minimum amount of liability in order to license the vehicle. In Nebraska these limits are 25/50/25 which means you must have $25,000 of bodily injury coverage per person, $50,000 of bodily injury coverage per accident, and $25,000 of property damage coverage.

- If you have a loan on your ZDX, it’s most likely the lender will force you to buy full coverage to ensure the loan is repaid in case of a total loss. If coverage lapses or is canceled, the lender will be forced to insure your Acura for a much higher rate and require you to fork over for it.

- Insurance safeguards not only your Acura but also your assets. It will also pay for medical bills for both you and anyone you injure as the result of an accident. Liability insurance will also pay to defend you if you cause an accident and are sued. If you have damage to your Acura as the result of the weather or an accident, comprehensive and/or collision insurance will pay to repair the damage.

The benefits of carrying adequate insurance more than cancel out the cost, specifically if you ever have a liability claim. The average driver in Nebraska is overpaying over $865 each year so it’s recommended you shop around once a year at a minimum to ensure rates are inline.