Surprisingly, a recent survey revealed that nearly 70% of customers have purchased from the same company for four years or more, and approximately 38% of consumers have never shopped around. Most drivers in America can save hundreds of dollars each year, but most undervalue the actual amount they would save if they switched.

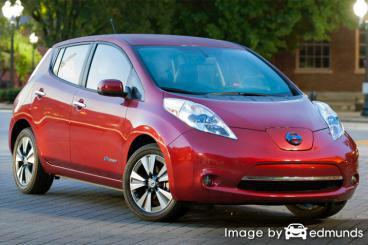

If you want to find the absolute lowest rates, then the best way to get affordable Nissan Leaf insurance in Omaha is to start doing a yearly price comparison from insurers who can sell car insurance in Nebraska. You can shop around by following these steps.

If you want to find the absolute lowest rates, then the best way to get affordable Nissan Leaf insurance in Omaha is to start doing a yearly price comparison from insurers who can sell car insurance in Nebraska. You can shop around by following these steps.

- Step 1: Gain an understanding of coverages and the measures you can control to prevent high rates. Many rating factors that result in higher prices like at-fault accidents, speeding tickets, and a negative credit rating can be amended by paying attention to minor details. Continue reading for more information to find cheap prices and get bigger discounts.

- Step 2: Compare price quotes from exclusive agents, independent agents, and direct providers. Exclusive and direct companies can provide rates from a single company like Progressive and State Farm, while independent agencies can provide price quotes for a wide range of companies. Begin your rate comparison

- Step 3: Compare the quotes to your current policy premium and determine if there is any savings. If you find a lower rate quote, make sure there is no coverage gap between policies.

- Step 4: Provide notification to your current agent or company of your intent to cancel your current coverage. Submit a completed policy application and payment for your new policy. As soon as coverage is bound, place the new proof of insurance paperwork in your vehicle’s glove compartment or console.

An important note is to use identical limits and deductibles on every price quote and and to get rate quotes from as many different insurance providers as possible. Doing this ensures a fair rate comparison and a good representation of prices.

Omaha Insurance Rates are Influenced by These Factors

Smart consumers have a good feel for the factors that help calculate the rates you pay for insurance. When consumers understand what impacts premium levels, this allows you to make educated decisions that may reward you with lower rates. Many things are taken into consideration when you quote your car insurance policy. Some factors are common sense like a motor vehicle report, although others are more obscure like where you live and annual miles driven.

Men are more aggressive – Statistics demonstrate women tend to be less risk to insure than men. It does not mean men are WORSE drivers than women. Females and males are responsible for accidents at a similar rate, but guys have accidents that have higher claims. Men also receive more costly citations like DUI and reckless driving.

Inexpensive frequent claims are not good – If you’re an insured who likes to file claims you can expect either policy cancellation or increased premiums. Car insurance companies in Nebraska give lower rates to policyholders who do not rely on their insurance for small claims. Auto insurance is intended for the large, substantial claims.

Traffic violations cost more than a fine – Only having one citation can increase rates by as much as thirty percent. Drivers with clean records have lower premiums as compared to those with violations. Drivers who have severe violations such as DUI, reckless driving or excessive speeding are required to maintain a SR-22 to the state department of motor vehicles in order to keep their license.

Drive a safer car and pay less – Vehicles with high crash test scores get lower rates. Safer cars reduce injuries and fewer serious injuries means less money paid by your insurance company which can result in lower premiums.

Liability protection safeguards assets – Your policy’s liability coverage will provide protection if ever a court rules you are at fault for an accident. This coverage provides you with a defense in court up to the limits shown on your policy. This coverage is very inexpensive compared to physical damage coverage, so drivers should buy more than the minimum limits required by law.

Marriage can save you money – Walking down the aisle actually saves money on your policy. Having a spouse translates into being more mature than a single person and it’s proven that married drivers tend to have fewer serious accidents.

Nissan Leaf claim data – Car insurance companies analyze historical claim data as a way to help calculate a profitable premium price. Vehicles that statistically have high amounts or severity of claims will have higher premium rates. The table below outlines the collected loss data for Nissan Leaf vehicles.

For each type of coverage, the statistical loss for all vehicles, without regard to make or model, is represented as 100. Values that are under 100 represent a good loss history, while values that are above 100 indicate higher probability of having a loss or an increased probability of a larger loss.

| Specific Nissan Model | Collision | Property Damage | Comp | Personal Injury | Medical Payment | Bodily Injury |

|---|---|---|---|---|---|---|

| Nissan Leaf Electric | 89 | 84 | 45 | 83 | 64 | 76 |

Data Source: Insurance Institute for Highway Safety for 2013-2015 Model Years

Discounts for cheaper insurance rates

Companies don’t always publicize the complete list of policy discounts in an easy-to-find place, so the list below contains a few of the more common and the harder-to-find credits available to bring down your rates.

- Accident Free – Good drivers with no accidents pay much less as opposed to drivers who are more careless.

- Drive Safe and Save – Insureds without accidents can save as much as half off their rates than drivers with accidents.

- Discounts for Multiple Vehicles – Having all your vehicles with one company could earn a price break for each car.

- Savings for New Vehicles – Buying a new car model may earn a small discount because newer vehicles have to meet stringent safety requirements.

- College Student – Kids who live away from home at college and don’t have a car may be able to be covered for less.

- Active Service Discounts – Being deployed with a military unit could qualify you for better prices.

- Discount for Good Grades – Maintaining excellent grades can save 20 to 25%. Earning this discount can benefit you well after school through age 25.

- Theft Prevention System – Cars, trucks, and SUVs with anti-theft systems are stolen less frequently and therefore earn up to a 10% discount.

- Fewer Miles Equal More Savings – Low annual miles can earn slightly better insurance rates than normal.

One last thing about discounts, most discounts do not apply to the entire policy premium. Most only apply to the cost of specific coverages such as collision or personal injury protection. If you do the math and it seems like all those discounts means the company will pay you, it just doesn’t work that way.

A list of companies and their possible discounts are shown below.

- GEICO has discounts for federal employee, good student, daytime running lights, anti-theft, driver training, five-year accident-free, and air bags.

- MetLife may offer discounts for accident-free, claim-free, multi-policy, defensive driver, and good driver.

- State Farm offers premium reductions for anti-theft, driver’s education, safe vehicle, Steer Clear safe driver discount, and multiple autos.

- Progressive may have discounts that include multi-vehicle, online quote discount, good student, continuous coverage, homeowner, multi-policy, and online signing.

- Mercury Insurance may include discounts for multi-car, professional/association, annual mileage, good student, anti-theft, multi-policy, and age of vehicle.

- 21st Century offers discounts including good student, driver training, anti-lock brakes, defensive driver, 55 and older, and theft prevention.

- Allstate has savings for premier discount, new car, multi-policy, senior citizen, safe driver, and utility vehicle.

If you need inexpensive Omaha auto insurance quotes, ask all companies you are considering which discounts can lower your rates. Some credits may not apply to policies in Omaha. If you would like to view companies with the best Nissan Leaf insurance discounts in Omaha, click here.

Cheap car insurance premiums are possible

Cost effective Nissan Leaf insurance can be purchased both online and from local insurance agents, so get free Omaha auto insurance quotes from both of them in order to have the best price selection to choose from. There are still a few companies who don’t offer the ability to get a quote online and usually these regional insurance providers only sell through independent agents.

As you quote Omaha auto insurance, it’s not a good idea to skimp on coverage in order to save money. There have been many cases where consumers will sacrifice collision coverage and found out when filing a claim that a couple dollars of savings turned into a financial nightmare. Your aim should be to purchase plenty of coverage for the lowest cost but still have enough coverage for asset protection.

In this article, we presented many ways to compare Nissan Leaf insurance rates in Omaha. The key concept to understand is the more times you quote, the better your chances of lowering your auto insurance rates. You may even be surprised to find that the lowest rates come from a small mutual company. They can often provide lower auto insurance rates in certain areas than the large multi-state companies such as Progressive and GEICO.

More information can be found at the links below

- How to shop for a safer car (Insurance Institute for Highway Safety)

- How Much are Car Insurance Quotes for a Ford Escape in Omaha? (FAQ)

- Who Has Affordable Omaha Car Insurance Rates for a School Permit? (FAQ)

- Who Has the Cheapest Auto Insurance for Welfare Recipients in Omaha? (FAQ)

- Who Has Affordable Auto Insurance for Low Credit Scores in Omaha? (FAQ)

- What is a Telematics Device? (Allstate)

- Determining Auto Insurance Rates (GEICO)

- Think You’re a Safe Driver? (State Farm)

- Rental Car Insurance Tips (Insurance Information Institute)