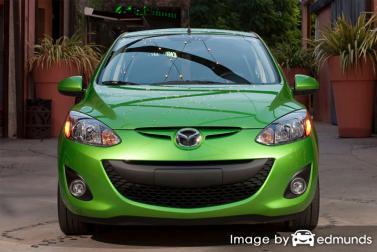

Pricey Mazda 2 insurance in Omaha can dry up your family’s budget, especially in this economy. Comparison shopping is a fast and free way to make sure you’re not throwing money away.

Shocking but true, a large majority of consumers have bought auto insurance from the same company for four years or more, and nearly the majority have never even compared quotes to find cheap rates. Drivers in Omaha could pocket 30% a year just by shopping around, but they underestimate how much they could save if they changed companies.

Shocking but true, a large majority of consumers have bought auto insurance from the same company for four years or more, and nearly the majority have never even compared quotes to find cheap rates. Drivers in Omaha could pocket 30% a year just by shopping around, but they underestimate how much they could save if they changed companies.

Vehicle owners have so many insurance companies to choose from, and although it’s nice to be able to choose, more options can take longer to find a good deal for Mazda 2 insurance in Omaha.

It’s smart to take a look at other company’s rates every six months because insurance prices tend to go up over time. Despite the fact that you may have had the lowest rates on Mazda 2 insurance in Omaha six months ago you may be paying too much now. Forget all the misinformation about auto insurance because you’re about to learn the things you must know in order to find better coverage on Mazda 2 insurance in Omaha at a better price.

Choosing the best rates in Omaha is really not that difficult. In a nutshell, each driver who wants cheaper insurance will more than likely get a lower-priced policy. But Nebraska drivers benefit from understanding how companies compete online because it varies considerably.

Most companies like State Farm, Allstate and GEICO allow consumers to get price estimates directly from their websites. This process doesn’t take much effort because you just enter your coverage preferences as requested by the quote form. Behind the scenes, their quoting system collects reports for credit and driving violations and returns pricing information based on many factors. Being able to quote online for Mazda 2 insurance in Omaha makes it easy to compare insurance prices and it’s also necessary to get many rate quotes if you are searching for a better rate.

To save time and find out how much you’re overpaying now, compare quotes from the companies shown below. To compare your current rates, we recommend you duplicate the coverage information exactly as they are listed on your policy. This helps ensure you will have a rate comparison based on the exact same insurance coverage.

The providers in the list below are our best choices to provide price quotes in Nebraska. If multiple companies are listed, it’s a good idea that you compare several of them to get the best price comparison.

Why you need to buy insurance

Despite the potentially high cost of Mazda 2 insurance, insurance serves several important purposes.

- The majority of states have minimum liability requirements which means you are required to carry a specific level of liability insurance coverage in order to be legal. In Nebraska these limits are 25/50/25 which means you must have $25,000 of bodily injury coverage per person, $50,000 of bodily injury coverage per accident, and $25,000 of property damage coverage.

- If you have a lien on your Mazda 2, it’s guaranteed your bank will make it a condition of the loan that you have full coverage to ensure the loan is repaid in case of a total loss. If you default on your policy, the bank may insure your Mazda at a much higher rate and require you to fork over much more than you were paying before.

- Insurance protects your car and your assets. It will also cover medical bills that are the result of an accident. Liability coverage, the one required by state law, will also pay attorney fees if you cause an accident and are sued. If your car is damaged in a storm or accident, collision and comprehensive (also known as other-than-collision) coverage will pay to repair the damage.

The benefits of carrying enough insurance are definitely more than the cost, specifically if you ever have a liability claim. Today the average American driver is currently overpaying as much as $865 each year so you should quote your policy with other companies each time the policy renews to save money.

Informed Decisions Result in Lower Insurance Rates

Many factors are part of the calculation when premium rates are determined. Some are obvious such as traffic violations, but other factors are less apparent like your vehicle usage or your vehicle rating. A large part of saving on car insurance is knowing the rating factors that play a part in calculating the price you pay for car insurance. If you know what impacts premium levels, this enables informed choices that can help you get much lower annual insurance costs.

Having a spouse brings a discount – Walking down the aisle helps lower the price on your car insurance policy. Marriage generally demonstrates drivers are less irresponsible and statistics prove married couples file fewer claims.

Keep car insurance rates low by being claim-free – Auto insurance companies in Nebraska award better rates to people who are claim-free. If you frequently file small claims, you can look forward to either a policy non-renewal or much higher rates. Your insurance policy is intended to be relied upon for claims that pose a financial burden.

Urban residents pay more – Residing in areas with lower population is a good thing when shopping for auto insurance. Less people living in that area corresponds to lower accident rates and a lower car theft rate. Residents of big cities tend to have congested traffic and a longer drive to work. More time behind the wheel statistically corresponds to a higher accident and claim rate.

More performance means more cost – The type of car you are buying insurance for makes a significant difference in your rates. The lowest performance passenger vehicles receive the most favorable rates, but your final cost has many other factors.

Male rates may be higher – Over the last 50 years, statistics have shown that females take fewer risks when driving. That doesn’t necessarily mean that men are WORSE drivers than women. Males and females cause fender benders at about the same rate, but the males get into accidents with more damage. In addition to higher claims, males also receive more costly citations like reckless driving and DUI. Youthful male drivers are the most expensive to insure and therefore have the most expensive car insurance rates.

Teenagers are high risk – Older drivers tend to be more responsible, cost insurance companies less in claims, and tend to be get fewer driving tickets. Teen drivers are proven to be careless and easily distracted when at the wheel of a vehicle so car insurance rates are higher.

Only buy what you need – Insurance companies have many add-on coverages you can purchase but may not be useful. Coverage for things like personal injury protection, accidental death, and motor club memberships are probably not needed. These coverages may sound good when deciding what coverages you need, but if you have no use for them consider taking them off your policy.

What is the best car insurance company in Nebraska?

Insuring your vehicle with the right auto insurance company can be a challenge considering how many choices you have in Nebraska. The company ratings in the lists below could help you select which car insurance companies to look at purchasing a policy from.

Top 10 Omaha Car Insurance Companies Overall

- USAA

- 21st Century

- GEICO

- Nationwide

- AAA Insurance

- Liberty Mutual

- Safeco Insurance

- State Farm

- Travelers

- American Family

Shop smart and save

The cheapest Mazda 2 insurance in Omaha is attainable on the web in addition to many Omaha insurance agents, so you need to quote Omaha auto insurance with both to have the best selection. Some auto insurance companies may not offer rate quotes online and usually these regional insurance providers sell through independent agents.

Throughout this article, we presented a lot of information how to shop for Mazda 2 insurance online. The key concept to understand is the more quotes you get, the higher your chance of finding cheaper Omaha auto insurance quotes. Consumers may even find the lowest premium rates come from a smaller regional carrier. Some small companies often have lower prices on specific markets than the large multi-state companies such as Allstate or State Farm.

Steps to finding cheaper rates for Mazda 2 insurance in Omaha

Really, the only way to find low-cost Mazda 2 insurance is to do a yearly price comparison from insurance carriers who sell insurance in Omaha. You can shop around by following these guidelines.

- Take a little time to learn about what is in your policy and the factors you can control to drop your rates. Many risk factors that result in higher prices such as traffic citations, accidents, and a substandard credit history can be remedied by paying attention to minor details.

- Request rate estimates from direct carriers, independent agents, and exclusive agents. Exclusive agents and direct companies can give quotes from one company like GEICO or Farmers Insurance, while independent agents can provide price quotes for a wide range of companies. View insurance agents

- Compare the quotes to your existing coverage to determine if switching companies saves money. If you find a lower rate quote, make sure coverage does not lapse between policies.

- Notify your company or agent of your intent to cancel your current policy and submit a down payment along with a completed application to the newly selected company. Be sure to place your new proof of insurance paperwork in an accessible location in your vehicle.

The key thing to know about shopping around is to use the same coverage limits and deductibles on every quote request and and to compare every company you can. This ensures a fair price comparison and and a good selection of different prices.

To read more, feel free to visit the resources below:

- Child Safety FAQ (iihs.org)

- How Much are Omaha Auto Insurance Rates for Drivers Over Age 70? (FAQ)

- How Much are Auto Insurance Rates for Single Moms in Omaha? (FAQ)

- What Car Insurance is Cheapest for Immigrants in Omaha? (FAQ)

- How Much are Omaha Auto Insurance Rates for 18 Year Olds? (FAQ)

- How Much are Omaha Car Insurance Rates for Uninsured Drivers? (FAQ)

- Who Has the Cheapest Auto Insurance for Safe Drivers in Omaha? (FAQ)

- Who Has Cheap Car Insurance for Drivers Requiring a SR22 in Omaha? (FAQ)

- What Insurance is Cheapest for a Nissan Sentra in Omaha? (FAQ)

- Determining Auto Insurance Rates (GEICO)

- Five Tips to Save on Auto Insurance (Insurance Information Institute)

- Understanding Your Insurance Deductible (Insurance Information Institute)